capital gains tax canada 2020

Iain Butler and his team at Motley Fool Canadas Stock Advisor have released a special free report detailing 5. 1216 on the portion of your taxable income that is more than 150000 but not more than 220000 plus.

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in.

. While all Canada Revenue Agency web content is accessible we also provide our forms and publications in alternate formats digital audio electronic text Braille and large print to allow persons with disabilities to access the information they need. Accordingly the deduction limit for capital gains on QSBCS dispositions in 2019 is 433456 12 a LCGE amount of 866912. Yukon enjoy a reduced MP income tax rate of 15 in 2020.

Schedule 3 is used by individuals to calculate capital gains or losses. How to calculate capital gains tax. Only 50 of your capital gains are taxable.

Accordingly the actual income that you would be taxed on at your marginal tax rate would be 1750. A Capital Gains tax was first introduced in Canada by Pierre Trudeau and his finance minister Edgar Benson in the. 1316 on the portion of your taxable income that is more than 220000.

For example if you bought a stock for 10 and sold it for 50 but paid broker fees of 5 you would have a capital gain of 35. Since its more than your ACB you have a capital gain. There is no special capital gains tax in Canada.

For tax purposes the gain would only be half of 35. An QSBCS disposition in 2020 will result in gains of 441692 per LCGE of 883384 or a deduction of 22 percent of the LCGE. Because you only include one half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 500000 12 of a LCGE of 1000000.

Dividends distributed within taxable periods commencing after 1 January 2020 arising from entities operating under the legal form of Société Anonyme or Limited Liability are taxed via corporate withholding taxation. That way they can pay as little capital gains tax as possible for 2020. For more information see What is the capital gains deduction limit.

The sale price minus your ACB is the capital gain that youll need to pay tax on. In our example you would have to include 1325 2650 x 50 in your income. For best results download and open this form in Adobe ReaderSee General information for details.

How to reduce or avoid capital gains tax in Canada. Yukon will decrease its small business MP income tax rate to 0 from 15 effective January 1 2021. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax.

There are several ways to legally reduce and in some cases avoid paying taxes on capital gains. Previous-year versions are also available. Dont forget though that there are also Federal tax rates that you must consider when calculating your total taxes on your taxable income.

Guidance on affidavits and valuations Bill C-208 As of June 2021 changes to the Income Tax Act have altered the tax treatment of family transfers of shares in a qualified small business corporation and shares of the capital stock of a family farm or fishing corporation. Use the simple annual Capital Gains Tax Calculator or complete a comprehensive income tax calculation with the annual income tax calculator 2022. 4 canadacataxes Table of contents Page Page Definitions.

For more information see page 13. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22 to 35 bracket levels. 4 The federal and provincialterritorial tax rates shown in the tables apply to investment income earned by a CCPC other than capital gains and dividends received from.

How Much Capital Gains Is Tax Free In Canada. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and gross income. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year.

T4037 Capital Gains 2021. One of the more generous aspects of Canadian taxation is the Lifetime Capital Gains Exemption LCGEFor the 2020 tax year if you sold Qualified Small Business Corporation Shares QSBCS your gains may be eligible for the 883384 exemptionHowever you need to submit the appropriate form and documentation as the exemption is not automatic. The capital gains deduction limit on gains arising from dispositions of QSBCS in 2020 is 441692 12 of a LCGE of 883384.

Generally capital gains are taxed on half of the gain. Whats new for 2020. You can view this form in.

For people with visual impairments the following alternate formats are also available. And since 50 of the value of any capital gains is taxable you must then multiply the capital gains by 50 to determine the amount to add to your income tax and benefit return. Capital gains tax is calculated as follows.

Your sale price 3950- your ACB 13002650. Instead capital gains are taxed at your personal income tax rate. In Canada 50 of the value of any capital gains is taxable.

Proceeds of disposition Adjusted cost base Expenses on disposition Capital gain. Lifetime capital gains exemption limit For dispositions in 2020 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to 883384. This means that only half of your capital gains.

The capital gains tax rate in Ontario for the highest income bracket is 2676.

Mutual Fund Investing Common Questions About Taxes In Non Registered Accounts

Capital Gains Tax Calculator For Relative Value Investing

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Taxtips Ca Business 2020 Corporate Income Tax Rates

Possible Changes Coming To Tax On Capital Gains In Canada

Taxtips Ca Ontario 2019 2020 Income Tax Rates

Reporting Capital Gains Dividend Income Is Complex Morningstar

Understanding Taxes And Your Investments

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Capital Gains Tax In Canada Explained Youtube

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Capital Gains Tax In Canada Explained

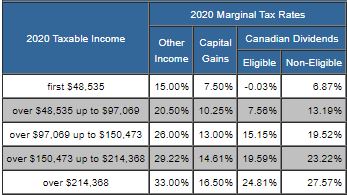

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Taxtips Ca Canadian Dividends No Tax

Taxtips Ca Canada S Top Marginal Tax Rates By Province Territory